From the WSJ:

The yen has risen in large part after fears of a U.S. credit crisis this week reversed a trading strategy called the carry trade. Under the carry trade, investors borrow money in countries with low interest rates, such as Japan, to invest in assets in countries with higher rates. The move, considered a lucrative foreign-exchange tactic in recent years, has pushed the Japanese currency to its lowest level in years against other currencies. But over the past week, investors have been selling some of the riskier assets bought in other currencies to pay back the yen they had borrowed, leading to a rise in the yen.

Some analysts say the yen could appreciate further. "This could snowball," said Marshall Gittler, Chief Asia Strategist for Deutsche Bank AG's private wealth management group. Mr. Gittler believes that the yen's fair value could be even higher at less than ¥90 to the dollar.

The current situation in the global credit markets is creating a big problem in this strategy:

From Thompson Financial

A worsening credit crisis in the US which is slowly engulfing the global debt market will accelerate unwinding of yen carry trades and lift the Japanese currency to new highs, analysts said on Friday.

....

The near zero interest rate in Japan in recent years had offered investors virtually free money to finance their leveraged investment, dragging the yen to as low as 124.12 versus the dollar on June 22 this year, its weakest since December 2002.

But as worries about tighter credit, triggered by the problems in the US subprime mortgage sector, spilled onto the global market and shook equity markets across the globe, investors are now rushing to unwind their positions and convert them back into the yen.

From Bloomberg:

The yen was poised for its biggest weekly gain versus the dollar and euro in almost nine years as traders dumped investments funded by loans in Japan.

The yen rose against all currencies this week as turmoil in credit markets and a global rout in corporate bonds and stocks prompted an exodus from so-called carry trades. The Japanese currency had its steepest gain versus the New Zealand dollar, a favorite for such trades, in more than three decades.

...

UBS AG said its Risk Index reached a record 2.53, higher than after the Sept. 11, 2001, terrorist attacks on the U.S. and the collapse of hedge fund Long-Term Capital Management LP in October 1998. The yen, which had been weakening for years, subsequently surged 20 percent in less than two months as investors who'd borrowed cheaply in the currency rushed to exit.

``Our Risk Index signals it's a crisis that may be similar to or even worse than 1998,'' Muta said.

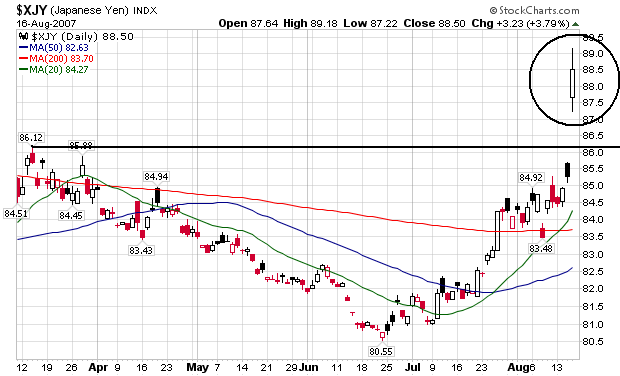

Let's look at the chart to see what is going on.

Here's the daily chart which clearly shows the yen has spiked higher on this movement in the global currency markets.

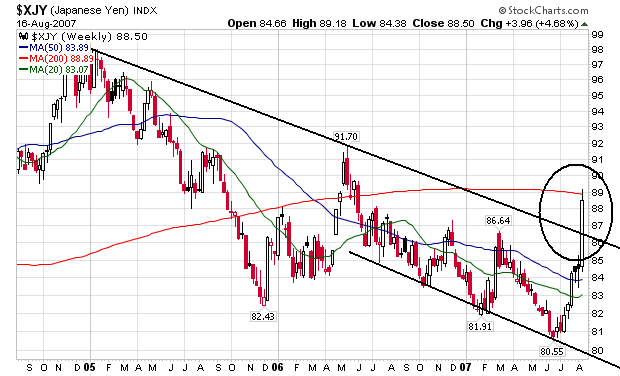

And here's the weekly chart. Notice the yen was in a downward sloping range for the last few years. Now it has broken out of that range in a big way. This is going to roil traders and probably increase the move back into the yen.

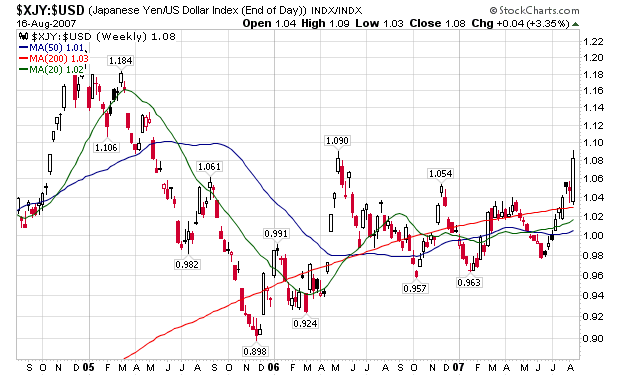

Here is a chart of the yen/dollar over the last few years. Notice the currencies have been in a relatively stable relationship. This week's spike in the yen threatens that stable relationship, forcing more traders to unwind carry-trades, spiking the yen, which will force more traders to liquidate carry-trades....you get the idea.