The Russell 2000 is a mess. It's been trading in a range for the better part of a month now. Traders are shying away from smaller issues because of their higher beta and perceived higher level of risk. While a quick jump might happen, I don't think this average is going to impress on the upside until it first moves above the 50 day SMA.

The SPYs -- like the Russell -- have been consolidating around the 200 day SMA and roughly between the lines on the chart. The 10 and the 20 day SMA are moving up. In addition, with a weak dollar and strong international markets, larger companies with strong international exposure should benefit.

The utility average is breaking out of a downward sloping correction. Lower rates make borrowing cheaper (which is always good for capital intensive industries). In addition, utilities may benefit from a flight to safety.

Technology has benefited from their not being involved in the mortgage markets. There is also a theory that tech will "save the market" as it were. This ETF has risen for the last few weeks and is currently at its trend line.

I've written about health care before, but only from a technical perspective. This ETF is moving up it's trendline. It is also resting on the line that use to be resistance but is now acting as support. Like utilities, this index would benefit from a flight to safety.

If you're going to go long, I think basic materials is your best bet. The global infrastructure play is still around and will be for awhile. This ETF has consolidated in a cup and handle formation. In addition, lower interest rates = lower cost of capital.

SO, if Bonddad was going to do a Fed trade, he would look at basic materials and utilities as sectors that would clearly benefit from lower interest rates and are technically interesting right now. Health Care is still a good defensive play and technology is rising because it's not mortgage/housing related.

HOWEVER -- I want to caution in the strongest possible language, I still don't like this market. First, the underlying economic fundamentals aren't good right now. The latest employment report was terrible and housing is a mess. Retail sales/personal spending is fair but not great. In short, a rate cut now would be an attempt to prevent further economic damage as much as promote growth. Those are not bull market fundamentals that I want to see.

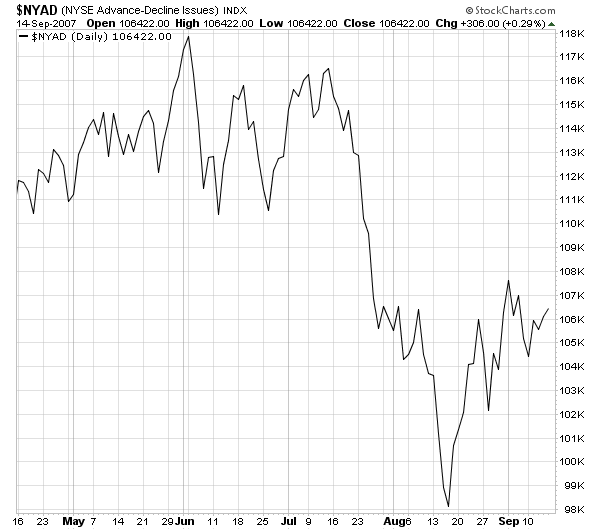

In addition, market internals aren't good.

The NY advance/decline line may be moving higher, but it's still too early to make that call. I would want to see this indicator move over the 109 for good measure.

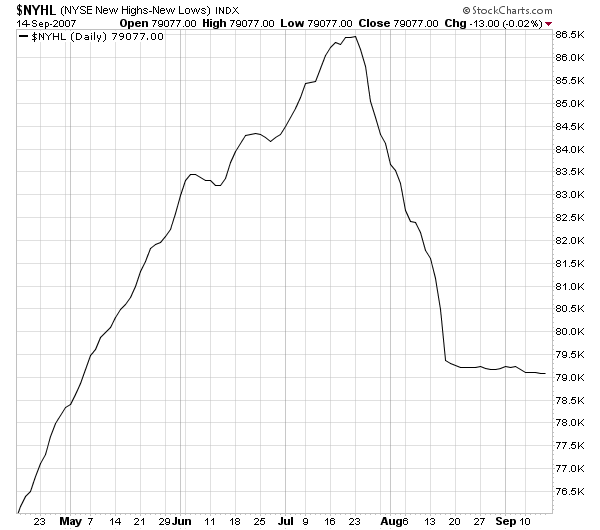

The NY New Highs/New Lows are rotten. This is not the trend you want to see in an advancing market.

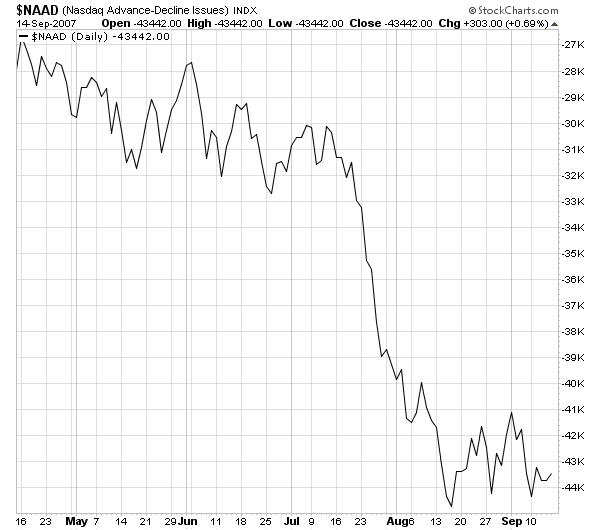

The NASDAQ advance/decline lines are trading in a range. This indicates that further upward moves would be in an extremely difficult environment.

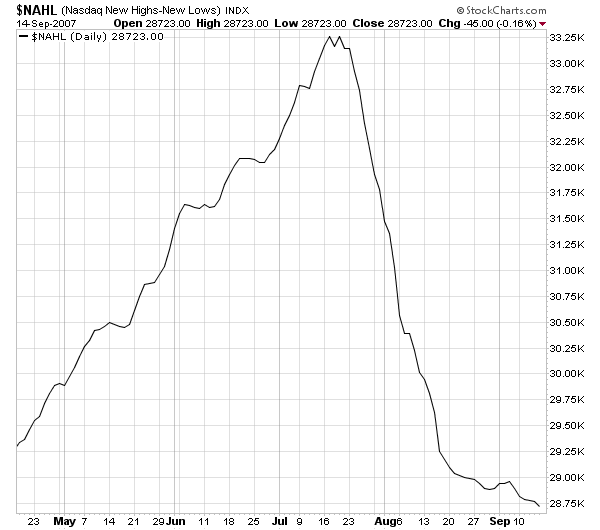

And the NASDAQ new high/new low index is declining.

The bottom line is if I were going long, I would go long for a very short time frame, make a quick trade then get the hell out.

Today's WSJ makes the following point:

Though the stock market surged last week on optimism that a widely expected interest-rate cut by the Fed would boost stocks, such a rate cut would offer little immediate help for the fundamental problems weighing on the nation's economy and financial markets. These include a worsening housing slump and high gasoline prices, which are damping consumer spending, and fears of further defaults on the billions of dollars of low-quality loans that have been used to finance mortgages and corporate takeovers.

Even if the Fed carries out a series of rate cuts, the economy and stock market are likely to be dealing with the fallout from these problems well into next year.