European Central Bank officials said food costs and record oil prices are fanning inflation pressures in the 13 euro nations, suggesting they may support further interest-rate increases.

``Inflation risks have increased recently'' and the ECB will ``have to counter these risks should they materialize,'' said Germany's Axel Weber in an Oct. 20 interview after a meeting of the Group of Seven nations in Washington. Austrian colleague Klaus Liebscher said the threat of faster inflation is ``significant.''

...

Trichet said Oct. 19 it's ``clear'' a further increase in energy costs will have ``an inflationary impact.'' Liebscher said ``there is no relaxation concerning the risks to price stability, it's the other way around.'' Greece's Nicholas Garganas said he's also concerned about prices in 2008.

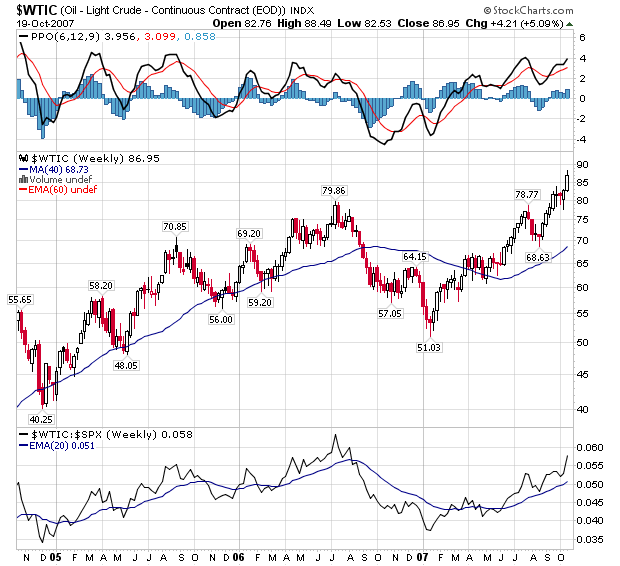

Policy makers said the surge in energy costs is likely to keep inflation above the ECB's limit this year and next. Weber said futures markets show investors expect the cost of crude to stay ``above what we had based our projections on.''

Compare the above to this:

Federal Reserve Governor Frederic Mishkin said inflation measures that exclude food and energy costs are a ``better guide'' to underlying changes in prices.

Changes in price indexes without food and energy ``provide a clearer picture of underlying inflation pressures,'' Mishkin said in the text of remarks to the HEC Montreal Macroeconomics and Monetary Policy Conference today. ``If the monetary authorities react to headline inflation numbers, they run the risk of responding to merely temporary fluctuations.''

Mishkin argued that both so-called core and headline measures of inflation are useful to policy makers and the central bank shouldn't rely on any one gauge. Sustained increases in energy costs can push up expectations for inflation, he said, noting that recent gains in oil are a ``reminder that shocks can persist longer than one might have first expected.''

One set of central bankers can read a chart like this one:

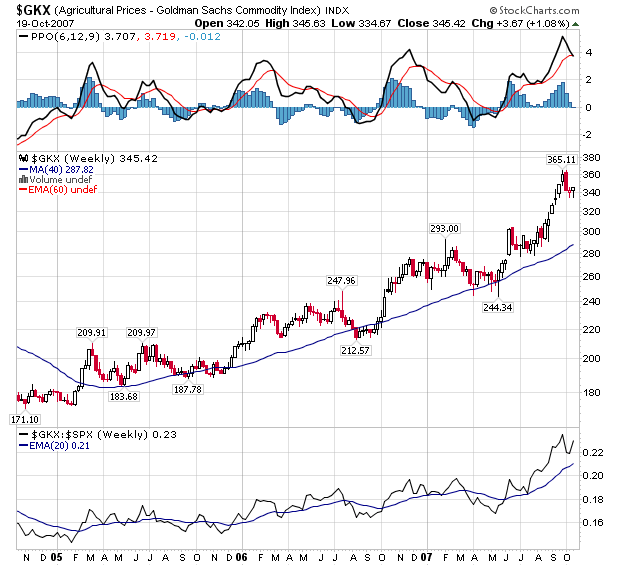

And this one:

One set of central bankers either can't read a chart or doesn't think the above charts are that important.