The U.S. is probably in or about to enter a recession, former Federal Reserve Chairman Alan Greenspan said.

The odds are "not overwhelming but they are marginally in that direction" of recession, Mr. Greenspan said in an interview with The Wall Street Journal.

"The symptoms are clearly there. Recessions don't happen smoothly. They are usually signaled by a discontinuity in the market place, and the data of recent weeks could very well be characterized in that manner," he said.

And you helped to get us here, Mr. "Throw money at any financial problem that comes down the pike."

Remember these interest rates, Alan?

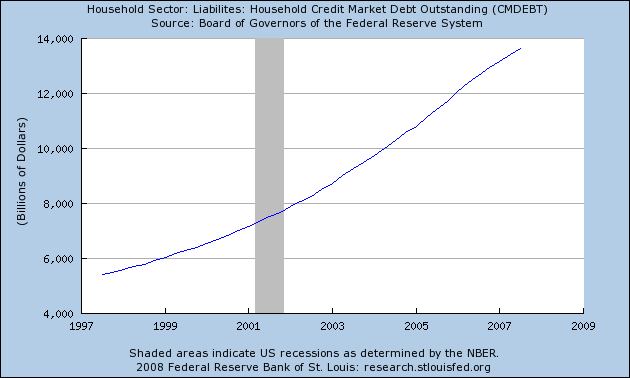

That's the Fed Funds rate. When you lower it to 0% after adjusting for inflation, you encourage people to borrow. And that's exactly what happened:

All of that household debt -- which is now larger than the entire US GDP -- has to go somewhere. But most importantly, it assumes a certain underlying asset value. Well, right now Alan, that asset value is decreasing. Have you seen the Case Schiller Home Price index lately?

Home prices spiked thanks to easy credit. But of course, the Federal Reserve was absolutely helpless for the entire process. It's not their fault that people borrowed recklessly (even though the Federal Reserve was well aware of lenders stupidity regarding loan policy and the Fed did nothing to stop it) or that asset prices spiked thanks to record low interest rates (but the Fed can't do anything about asset bubbles).

Alan, please, for the love of God, shut up.

Or -- will the financial press please start calling him on his part in this mess rather than viewing him as some sage?

End rant -- for now.