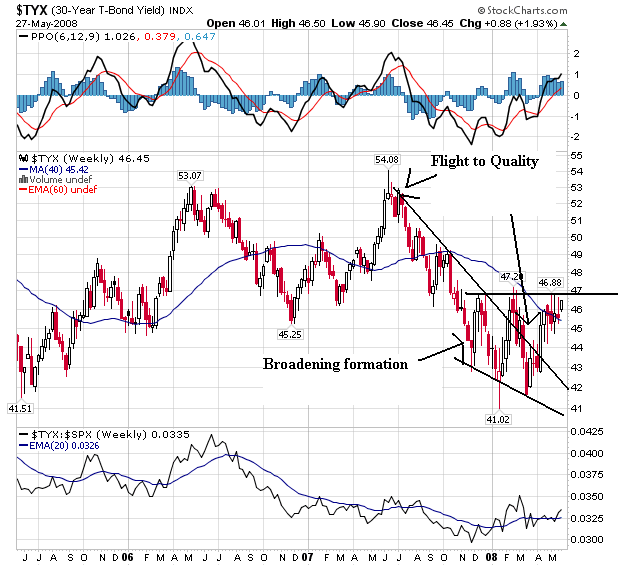

On the weekly 30-year yield chart, notice that yields are in a broadening pattern, moving between 4.20% and 4.60%. Also notice the yields have broken through resistance that started with the flight to quality at the end of last summer. The question now is will yields go higher or stay in this area.

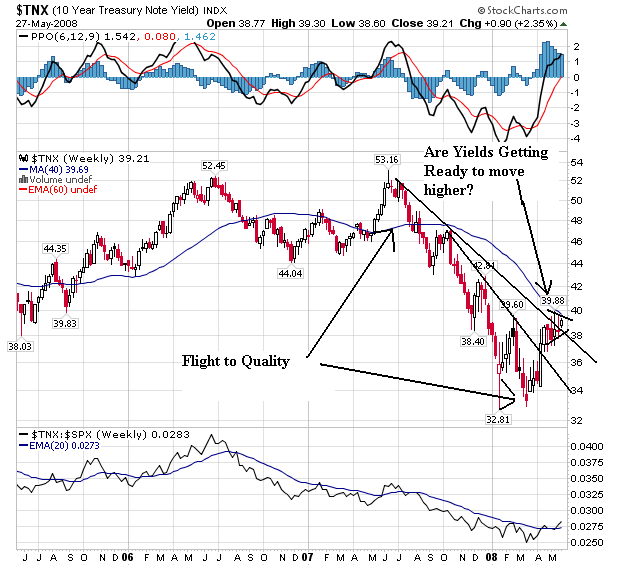

Notice the exact same situation with the 10-year -- that yields have broken through resistance that started at the end of last summer with the flight to quality. As with the 30-year, the question now is where will yields go from here.

Inflation is starting to take a toll on investors attitudes about government debt:

Inflation worries driven mainly by surging oil prices mean government-bond markets across the developed world may be in for a rough period.

Bonds are being weighed down by views that rising price pressures mean not just a halt to interest-rate cuts in the U.S. and the U.K. Concerns also are emerging that price pressures could force the Federal Reserve and the European Central Bank to raise borrowing costs later this year.

To be sure, the recent heavy selloff that has pushed yields higher may attract bargain-hunting investors. Disappointing economic data may also encourage some buying. But a more consistently upbeat tone may not be found until later this year, when growth might slow to a point that will push inflation worries to the back burner.

"We still see yields being pushed higher in the short term," said Cyril Beuzit, head of interest-rate strategy in London at BNP Paribas SA. "We need to see better news on the inflation front, or commodities prices fall a bit, or a significant setback in [stocks] or very weak data in the U.S. before the bond markets turn positive again."

But investor's risk appetite is also starting up a bit:

The $750 million sale Tuesday of bonds backed by auto loans to risky borrowers signals subprime isn't necessarily a bad word in the credit markets.

Deutsche Bank AG and Credit Suisse sold bonds backed by subprime auto loans issued by AmeriCredit Automobiles Receivables Trust, which increased the size from the $500 million planned, as buyers, mostly money managers, bid aggressively. The demand knocked risk premiums down 0.05 to 0.15 percentage point below expectations. "There's still a lot of money out there. And, this opens up the potential for deals with similar risks," said Derrick Wulf, a senior portfolio manager at Dwight Asset Management.

Many investors in the $2.5 trillion asset-backed securities market, where consumer debt is packaged into tradable bonds, viewed the AmeriCredit offering as a litmus test for risk appetite. The offering paired subprime debt with bond insurance -- two of the biggest casualties of the credit crisis. Financial Security Assurance is insuring the offering to give it a triple-A rating.

However, notice that total asset-backed paper is still dropping right now:

And while the Ted Spread has dropped, it's still pretty high:

And while 1-month libor is coming in a bit, 3-month libor is still wide indicating the short-term market still has some problems.