(Sigh...) Is there anything about economic indicators that Mish can get right? Apparently not.

Now he's launched a broadside against ECRI's recession calls (begrudgingly acknowledging at the end the correctness of their Great Recession bottom call last March). Now, ECRI are Big Boyz and Gurlz, so they can defend themselves (and they have). What I want to do is look at what he says about economic indicators generally.

First of all, here's what he says about the yield curve:

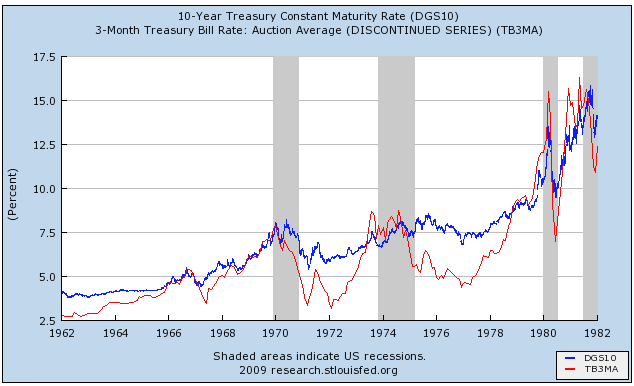

A strategy to exit the market on the ECRI's recession call is better than nothing, yet it leaves a lot on the table compared to a strategy of getting the hell out of the way when the yield curve inverts.Actually, while the yield curve is generally a good predictor of the economy, in times of inflation it actually has a better record giving "all clear" signals than when it inverts. Mish doesn't supply the actual graphs, but I will. Here's the 10 year vs. the 3 month from 1961-1980:

....

it's important to be fair. Inverted treasuries only predict recessions, they do not give "all clear" signals.

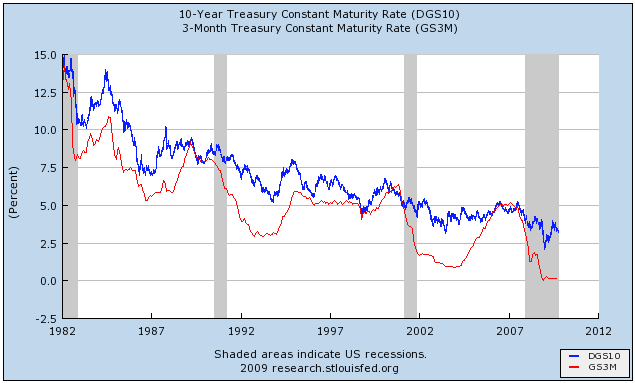

and here it is from 1980 to the present:

Had you predicted recession one year later every time the yield curve inverted, you would have had a false signal in 1966 and again in 1968. On the other hand, in times of inflation had you predicted recovery one year later every time the yield curve reverted to normalcy with at least a 1% difference between the long and the short bond, you would have had a perfect record.

In deflation the picture is more complicated -- an inverted yield curve, as in 1928-29 and 2007, means death, whereas a positively sloped curve only predicts recovery in the presence of abating deflation -- as in 1933 and now. (and no, deflation isn't deepening, not just as measured by the regular CPI. I debunked Mish's claim about the Case Schiller-CPI, showing that the CS-CPI also shows abating deflation compared with the bottom early this year, here).

So, why did Mish claim that the yield curve can't give the "all clear" sign? Maybe because it completely undercuts the narrative that caused him to miss a 3500 point (+55%) bull move in the DJIA during the last 7 months.

So what indicators does Mish think are worth following? Here's his conclusion:

This is what I see now: In spite of the change in the stock market, unemployment is high and rising, foreclosures are high and rising, banks are not lending, consumers are not spending, and the government is the buyer of only resort for mortgages. The deleveraging process continues while banks continue to tighten credit and finally, commercial real estate is imploding.Well, since Mish is interested in debunking poor indicators, how about we return the favor and look at his?

Those "real economy" conditions are not the makings of a strong recovery, perhaps not any recovery.

1. "unemployment is high and rising"

Gee, just like at the end of every prior recession and at the beginning of every prior recovery. Leading indicator? Ummm, no.

2. "foreclosures are high and rising"

Well, there aren't good national charts going way back, but here's a nice one from California:

Gee, I wasn't aware that 1995 was the peak of the recession. Leading indicator? Ummm, no.

3. "banks are not lending"

Again, exactly like at the end of every prior recession and frequently well into the subsequent recovery. Leading indicator? Ummm, no.

4. "consumers are not spending"

Now this graph of Personal Consumption Expenditures shows that usually consumer spending does uptick before the end of recessions, but now it's ... ummm ... also upticking. Leading indicator? Ummm, well actually, yes. It's just showing the opposite of what Mish claims.

5. "finally, commercial real estate is imploding"

Again, exactly like the end of every prior recession and at the beginning of a number of prior recoveries, including the last two.

Leading indicator? Ummm, no.

Mish's conclusion: "Those "real economy" conditions are not the makings of a strong recovery, perhaps not any recovery"

The truth: Mish is 0 for 5. A whopping 4 out of 5 are proven lagging indicators! The fifth, which is a leading indicator, he gets completely wrong. He's also flat out wrong about the implications of a positive yield curve as well. If he were right, recessions would have continued in 1975, 1983, 1992, 2002, and on and on -- instead of the recoveries which actually happened.

And let's not forget this classic bad call about rail traffic from June of this year in which Mish claimed: "Year over Year Percent Change - 13 Week Rolling Averages … are still moving lower, with no apparent end in sight", a call which almost exactly marked the bottom of that very* trailing indicator (*which was also borne out by the week over week averages on the very same page).

Like I said at the beginning: Is there anything about economic indicators that Mish can get right? Apparently not.

(Sigh....)

Meanwhile, Prof. Paul Krugman has jumped on the bandwagon, saying:

[I]n a zero-interest rate world ... conventional indicators don’t mean what they usually mean..... So historical correlations, to the extent that they exist ... can’t be counted on to prevail. There’s really no alternative to making fundamental analyses of the macro situation.

Huh?!? Even Homer nods, and here, the good Nobel-prize-winning professor has not just nodded, but completely lost his memory. To begin with, as I've reminded the professor on his own blog, the available data indicate that it is likely that the LEI's would have functioned correctly during the Great Depression, including the 1929-32 collapse.

Further, the LEI's are supposed to call turns in the economy 3-6 months out. The LEI's began to turn in April, when the economy was still in free-fall. Now most economists agree that the recession ended (even if employment still stinks) sometime during the summer -- i.e., 3-5 months later. But don't take my word on it -- take the word of a guy named ... Prof. Paul Krugman. Here's what he said just one week ago:

it’s fairly clear that the official records will eventually say that the recession ended in the summer of 2009.In other words, Krugman's assertion that the LEI's don't work in a zero-interest rate world isn't just undercut by looking at the likely LEI results from the 1930's. It is undercut by his own analysis of the present, which he reiterated only one week ago!