- by New Deal democrat

Yesterday's personal income and spending report is one of two data points in addition to the monthly jobs report that I think are especially important this week (the other being vehicle sales).

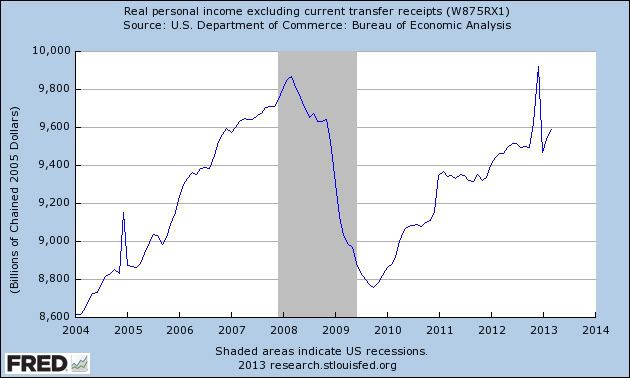

Personal spending is important because it is one of the 4 coincident indicators thought especially important in dating recessions and expansions, when normed for inflation and transfer payments. It rose im March for the second month in a row:

Note that the big December - January spike and decline were about the timing of payments like bonuses to minimize the implications of increases in tax rates. Leaving that anomaly aside, it's clear that real personal income is higher than at any point last year. This confirms that no recession has begun yet.

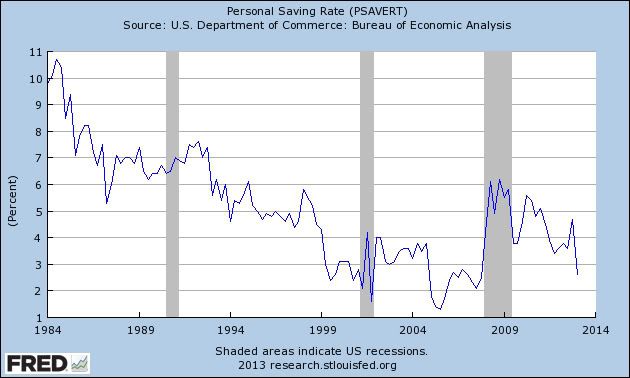

In the longer term, however, the biggest concern is the personal savings rate. With the increase in payroll taxes in January, what would the consumer do? After three months, we have our answer: the consumer continued to spend, by saving less. Below is the personal savings rate, calculated quarterly, and the result isn't pretty:

We now have a savings rate as low as what we had prior to the 2001 and 2008 recessions. It's true that we can go on this way for awhile, but there is no more maneuvering room. When consumers ultimately decide to save more and spend relatively less, that's when a recession happens.

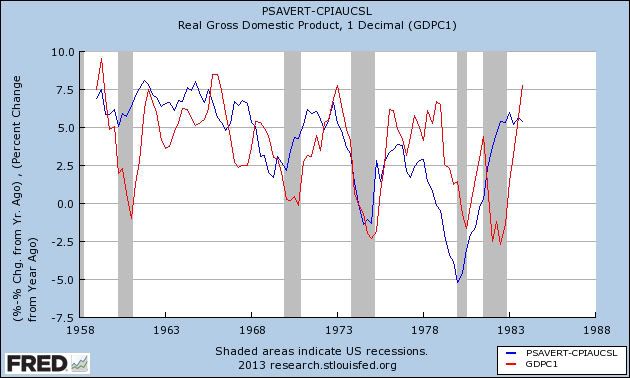

And here is an update on the long leading indicator of the real personal savings rate, i.e., the savings rate subtracting the inflation rate. First, here's the comparison of the real personal savings rate (blue) averaged on a quarterly basis, and real GDP (red) from 1958 through 1983:

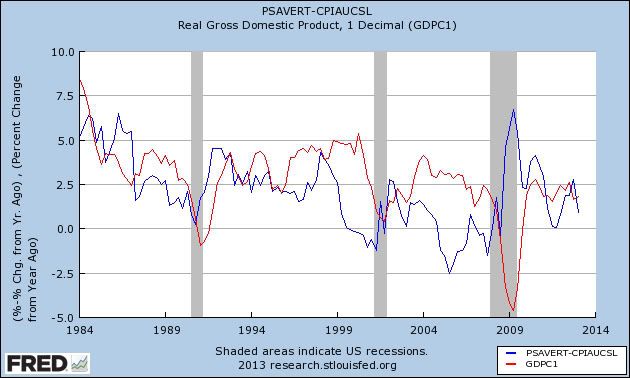

And here it is from 1984 through the first quarter of 2013:

The real personal savings rate tends to lead GDP by about 18 to 24 months. Two years ago the real personal savings rate fell to zero, which has always signalled a later recession. While I do not rely on any one indicator, and in fact all of the other long leading indicators are positive, the pathetic personal savings rate is not good news.